Reliance Industries Stock Analysis – 17 Aug 2025

Reliance Industries stock analysis on 17 Aug 2025. Key support, resistance, technical & fundamental insights for equity shares investors.

Reliance Industries has consistently been one of the most widely watched equity shares when it comes to investing in the Indian stock market. Being the biggest conglomerate in India, the company's financial results frequently influence the mood of the market and the financial industry as a whole.

Both short-term traders and long-term investors were interested in Reliance stock because it showed a slight bearish trend during today's session (17 August 2025). Let's examine its basic and technical prospects.

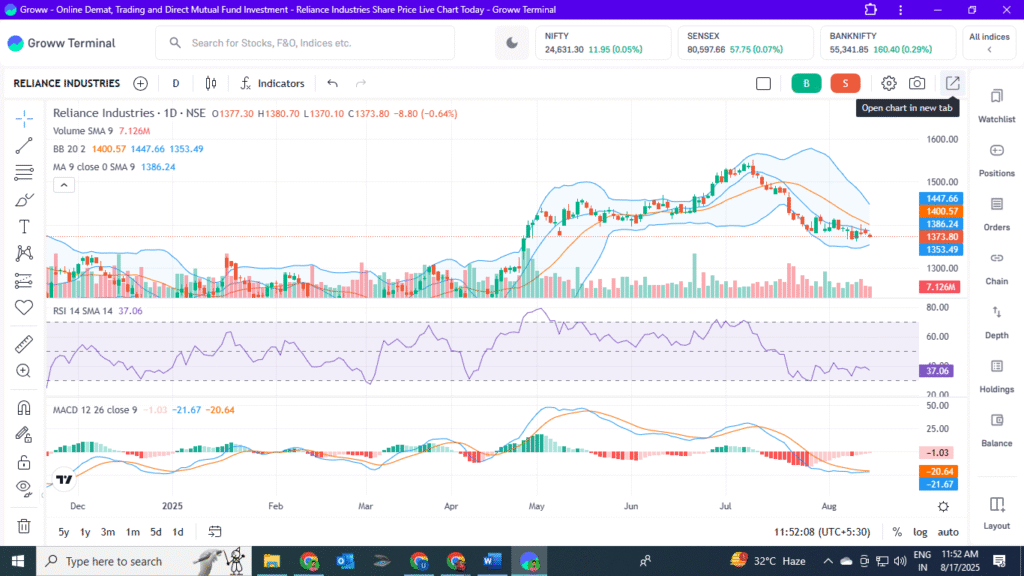

📊 Reliance Industries – Technical Analysis

Previous High: ₹1551

Previous Low: ₹1365

Today’s Price Movement:

Open: ₹1377.30

High: ₹1380.70

Low: ₹1370.10

Close: ₹1373.80

A small bearish candle formed today, reflecting cautious sentiment.

Previous Low: ₹1365

Today’s Price Movement:

Open: ₹1377.30

High: ₹1380.70

Low: ₹1370.10

Close: ₹1373.80

A small bearish candle formed today, reflecting cautious sentiment.

🔎 Important Technical Data

RSI (36): Close to the oversold area, indicating less room for decline.

MACD: A potential trend reversal signal is indicated by the line hitting the signal line from below.

SMA: Weak short-term momentum is indicated by a stock trading below its moving average.

Bollinger Bands:

Upper: ₹1447.66

Middle: ₹1400.57

Lower: ₹1353.49

The stock is close to the lower band, showing downside pressure but also the potential for a bounce.

📈 Support and Resistance Levels

Support 1: ₹1365 (previous low)

Support 2: ₹1353 (Bollinger lower band)

Resistance 1: ₹1400 (middle band + psychological level)

Resistance 2: ₹1447 (upper band)

Major Resistance: ₹1551 (recent high)

MACD: A potential trend reversal signal is indicated by the line hitting the signal line from below.

SMA: Weak short-term momentum is indicated by a stock trading below its moving average.

Bollinger Bands:

Upper: ₹1447.66

Middle: ₹1400.57

Lower: ₹1353.49

The stock is close to the lower band, showing downside pressure but also the potential for a bounce.

📈 Support and Resistance Levels

Support 1: ₹1365 (previous low)

Support 2: ₹1353 (Bollinger lower band)

Resistance 1: ₹1400 (middle band + psychological level)

Resistance 2: ₹1447 (upper band)

Major Resistance: ₹1551 (recent high)

📌 Plan of Action: Wait, Sell, or Buy?

Traders with short time horizons: Await confirmation. Buying may be triggered by a significant volume bounce above ₹1400.

Long-Term Investors: For equity shares, Reliance is still a good option. For a slow accumulation, dips around ₹1350–1365 may be taken into consideration.

Overall Advice: Hold off on making a new entry; build up on declines over time.

Long-Term Investors: For equity shares, Reliance is still a good option. For a slow accumulation, dips around ₹1350–1365 may be taken into consideration.

Overall Advice: Hold off on making a new entry; build up on declines over time.

🏢 Reliance Industries: Essential Perspectives

By market capitalization, Reliance Industries Limited (RIL), which was established by Dhirubhai Ambani and is headed by Mukesh Ambani, is the biggest private sector business in India.

Principal Business Units

Energy & Petrochemicals: Its foundation is still petrochemicals and refining.

Digital & Telecom Services: Jio Platforms has revolutionized the digital and telecom landscape in India.

Retail: Among India's biggest retail presences in the grocery, fashion, and internet sectors.

Principal Business Units

Energy & Petrochemicals: Its foundation is still petrochemicals and refining.

Digital & Telecom Services: Jio Platforms has revolutionized the digital and telecom landscape in India.

Retail: Among India's biggest retail presences in the grocery, fashion, and internet sectors.

Strength in Finances

Revenue Leadership: Among India's highest earners on a regular basis.

Debt Reduction: Jio and retail share sales resulted in a net debt reduction.

Future Development: Growing in digital finance, AI, and renewable energy.

Debt Reduction: Jio and retail share sales resulted in a net debt reduction.

Future Development: Growing in digital finance, AI, and renewable energy.

Global crude variations, FII moves, and market-wide declines are all putting pressure on Reliance stock. But, with the MACD indicating a possible crossover and the RSI close to oversold, mood might improve in the days ahead.

✅ Conclusion

Reliance Industries is currently trading in a weak technical zone, but its strong fundamentals keep long-term confidence intact. Traders should remain cautious, while long-term investors may look at dips for accumulation.

Support: ₹1365 / ₹1353

Resistance: ₹1400 / ₹1447 / ₹1551

Recommendation: Wait for now; long-term accumulation possible near support.

Support: ₹1365 / ₹1353

Resistance: ₹1400 / ₹1447 / ₹1551

Recommendation: Wait for now; long-term accumulation possible near support.

⚠️ Disclaimer:

This is not investment advice. All stock market investments are subject to risk. Please consult your financial advisor before making trading or investment decisions.