In the ever-changing realm of finance, time is crucial. Understanding economic events can significantly enhance your decision-making process, regardless of your level of experience as a trader or your desire to increase your equity share portfolio. An economic calendar becomes a very useful instrument at this point.

An economic calendar enumerates planned economic events and indications that impact India’s investment climate, including GDP growth, inflation data, RBI statements, and international cues. Gaining an advantage in the stock market might come from knowing how to read and apply it.

An Economic Calendar: What Is It?

A timetable of significant financial events that affect both domestic and international markets is known as an economic calendar. These consist of:

Monetary policy meetings of the RBI

Data on inflation (CPI and WPI)

Rates of GDP growth

Statistics on employment and unemployment

Updates on foreign exchange reserves

Announcements of corporate earnings

Global occurrences such as geopolitical tensions, crude oil prices, and U.S. Fed decisions

These occurrences may have an impact on sector-specific performance, market sentiment, and equity share pricing. Keeping an eye on this schedule is essential for Indian stock market investors, particularly those engaged in short- to medium-term trading.

The Significance of the Economic Calendar in Finance

Both internal and external forces have a significant impact on the Indian economy. Let’s say interest rates are raised by the Reserve Bank of India. Although this action typically increases the rupee, it can also decrease market liquidity, which frequently leads to falling stock prices. On the other hand, lowering interest rates might encourage investment in the banking and consumer industries.

The calendar assists in the following ways:

Predicting Market Volatility: Changes in the price of equity shares can be brought on by things like inflation data or releases of the Union Budget.

Sectoral influence: While CPI inflation data affects the FMCG and retail sectors, GDP data may have an influence on infrastructure and auto stocks.

Currency Movements: Foreign capital inflow and Nifty movement may be impacted by announcements of forex reserves or trade balance data.

The Indian Economic Calendar: How to Interpret It

Date and Time: Events are arranged according to when they are expected to be released. The timing of the pre-market or post-market is crucial since it affects how prices open the following day.

Event Name: The type of data being released (such as “India CPI YoY” or “RBI Interest Rate Decision”) will be indicated by each entry.

Impact Indicator: Low, medium, and high impact are the typical designations for events. Markets are more likely to move in response to high-impact events.

Actual versus Predicted versus Past:

Previous: The figure from the previous cycle.

Forecast: Analyst expectations or market consensus.

Actual: The current cycle’s reported statistics.

| Date | Event | Actual | Forecast | Previous | Impact |

| 12 June | CPI YoY (May) | 4.2% | 4.5% | 4.8% | High |

| 15 June | RBI Interest Rate Decision | 6.25% | 6.25% | 6.25% | High |

In this case, the CPI was lower than expected, which may be good news for equities in the consumer sector.

How to Incorporate It into Your Investment Plan

The economic calendar can be incorporated into your investment routine in the following ways:

1. Preparation for the Event

Determine the week’s high-impact events.

Major equity investments should not be made just before the release of volatile data unless risk management is part of your plan.

Examine the ramifications of future statistics for specific sectors.

2. Throughout the event

Keep an eye on any live updates that are accessible via websites like Moneycontrol, Investing.com, or NSE India.

Monitor the instant response in sectoral indexes, the Sensex, the Nifty 50, and other indicators.

3. Analysis After the Event

Compare the forecasted and actual results.

Analyze the response of your current equity shares.

Based on fresh information, modify your stop-loss limits or portfolio allocation.

Handy Advice

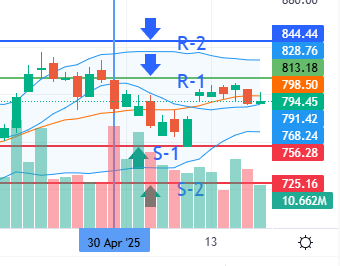

Combine Technical Analysis: To verify buy/sell signals, use charts in conjunction with economic developments.

Stay informed by subscribing to financial portals’ alerts for economic events.

Plan Swing Trades: Time your short-term investments to coincide with news releases that could spur growth in particular industries.

Steer clear of overreaction: Markets might occasionally respond to events in an unreasonable way. Before making significant investing decisions, allow volatility to subside.

🛠 Investing.com Economic Calendar (India) Tools You Can Use

India’s Trading Economics

Corporate Announcements from NSE India

RBI’s official website

Both macroeconomic and company-specific events are covered in detail by these systems’ data and alerts.

Wrapping Up

Anyone who is serious about finance and creating a wise investment portfolio in India needs an economic calendar, which is more than simply a tool for traders. Making better decisions is facilitated by knowing the importance of economic indicators and when to use them, particularly in the erratic world of stock prices.

Including the economic calendar in your analysis will improve your understanding of the market and raise your success rate, regardless of whether you are investing for the long run or attempting to profit from short-term fluctuations.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial advice. Investing in the stock market involves risks, and readers should do their own research or consult a qualified financial advisor before making any investment decisions. The views expressed are those of the author and may not reflect the opinions of this blog or its affiliates.