Overview

In the Indian financial industry, swing trading is growing in popularity, particularly among retail traders hoping to make money off short- to medium-term market fluctuations. Swing trading seeks to achieve equilibrium by capturing price fluctuations over a few days to weeks, in contrast to long-term investing, which necessitates patience over years, or intraday trading, which demands minute-by-minute monitoring.

This post will discuss tried-and-true swing trading methods, essential tools, and professional guidance specifically designed for the Indian market. This guide will assist you in investing in equities shares with greater clarity and discipline, regardless of your level of experience or desire to improve your trading skills.

What is Swing Trading, exactly?

To profit on anticipated upward or downward movements, swing traders purchase stocks and hold them for a few days to a few weeks. Technical signals, market sentiment, and occasionally fundamentals determine short-term trends and patterns.

Swing traders are quick to leave a position when the price target is reached, but they don’t mind overnight positions like scalping or intraday traders do.

📌 Essential Features of Swing Trading

| Parameter | Details |

| Holding Period | 2 days to 3 weeks |

| Goal | Capture “swings” in stock price |

| Tools Used | Technical indicators, chart patterns |

| Risk Level | Moderate to High |

| Time Requirement | 30–60 minutes/day for analysis |

📊 Successful Indian Swing Trading Techniques

1. A strategy for breaking out

✅Determine which stocks are exhibiting a consolidation pattern, such as triangles or flags.

✅When the price breaks above resistance with significant volume, enter the trade.

✅ Establish goals based on the height of the pattern and a stop-loss slightly below the support.

✅ When supported by volume, it performs well with equities such as Tata Motors, Zomato, or Reliance.

2. The Strategy of Pullback

✅ Use trendlines or moving averages to find a strong upward trend.

✅ Purchase when there is a brief decline (pullback) close to support or the 20 EMA.

✅ Sell close to the prior high or resistance.

✅ Best suited for popular equities such as Larsen & Toubro, Infosys, and HDFC Bank.

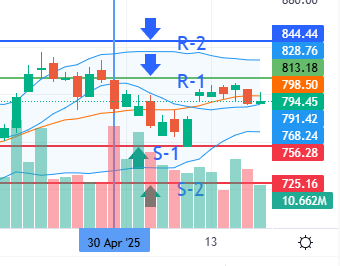

3. The Reversal Technique

✅ Use indicators such as MACD divergence, hammer/doji candles, or RSI (overbought/oversold) to identify trend reversals.

✅ Perfect for stocks near important levels of support and resistance

✅ Beneficial for pivotal moments in stocks such as SBI, IRCTC, or Adani Enterprises.

4. The Strategy of Gap Trading

✅During market opening, keep an eye out for notable price differences caused by news or earnings.

✅ With a stop-loss close to the gap fill area, trade in the gap’s direction.

✅ Frequently observed in small- and mid-cap stocks with erratic news flow.

🛠️ Best Resources for Indian Market Swing Trading

Swing traders must more than simply intuition to be successful. These are the necessary instruments:

Charting Frameworks

✅ TradingView: Instantaneous charting, alerts, and indicators

✅ Chartink: Free and dependable custom screeners

✅ Investing.com India: For a more comprehensive macro perspective

✅ Screeners: This website assists in filtering equity shares according to technical and fundamental criteria.

✅ Moneycontrol’s Watchlist: Monitor emotions and market movements

✅ Brokerage Apps with Smart Tools: Zerodha (Kite): Integrated TradingView charts and a clean interface

✅Upstox: Useful for swing inputs and exits; quick execution

ICICI Direct vs HDFC Securities: Evidence-based perspectives

📈 Indian Swing Trader Indicators

| Indicator | What It Shows | When to Use |

| Relative Strength Index (RSI) | Overbought/Oversold signals | Reversal setups |

| Moving Averages (20/50 EMA) | Short- and medium-term trend | Breakouts & pullbacks |

| MACD | Trend confirmation & divergence signals | Momentum confirmation |

| Volume | Strength behind price moves | Validate breakouts |

| Fibonacci Retracement | Support/resistance zones | Ideal for setting targets/entries |

Clever Suggestions for Swing Traders

✅ Start with stocks that are liquid.

✅ Choose well-liked mid-cap or large-cap stocks with low slippage and high volume.

✅ Adhere to a stop-loss strategy

✅ When swing trading, emotions can be risky. Establish a precise definition of risk to safeguard capital.

✅ Consider the risk-reward ratio.

✅ Make sure the profit is at least twice the risk before entering a transaction (2:1).

✅ Don’t overtrade.

✅ Setup quality is more important than quantity. When swing trading, patience is essential.

✅ Keep track of news and earnings dates.

✅ Keep abreast of business actions, quarterly results, and macroeconomic events that may have an impact on stock prices.

Typical Errors to Steer Clear of

❌ Trading without a strategy

❌ Predetermined entry, exit, and risk levels are necessary for swing trading.

❌Disregarding market patterns

❌Avoid going long during bear markets and shorting during bull ones.

❌Too long-term holding of losers

❌Hope is not a strategy, therefore respect your stop-loss.

❌Dependency on tips alone

❌Instead than using YouTube hype or WhatsApp forwards, use tools and analysis.

A Real-World Example

Consider a consolidation of Tata Consumer Products between ₹780 and ₹800. A bullish MACD crossover and increasing volume indicate a breakout above ₹800.

Input: ₹805

Stop-Loss: 780

₹860–870 is the target, based on past swing highs.

This trade fits the breakout technique and offers a reward-to-risk ratio of about 3:1.

Concluding Remarks

When combined with the right tools, discipline, and strategy, swing trading may be a very effective instrument for your Indian equities share investment journey. Unlike day trading, it doesn’t necessitate constant screen time, but it still requires careful consideration and emotional restraint.

Swing trading provides a useful intermediate route to increase your capital and acquire trading experience if you have a strong interest in finance and market movement.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial advice. Investing in the stock market involves risks, and readers should do their own research or consult a qualified financial advisor before making any investment decisions. The views expressed are those of the author and may not reflect the opinions of this blog or its affiliates.