What is the stock market? NexGen Trade: An Overview of the Indian Stock Market: An Investment Guide in the Indian Stock Market

You might have heard the word “stock market” used in discussions, the news, or even on social media if you’re new to the world of finance. However, what is the stock market and how does it operate, particularly in India?

The idea of the stock market, its function in the economy, and how it provides opportunities for people to increase their wealth through equity share investments will all be covered in this article. This handbook is for everyone, regardless of their experience level or desire to improve comprehension.

The stock market: What is it?

Buyers and sellers exchange financial products such as bonds, mutual funds, equity shares, and derivatives on the stock market. Fundamentally, it is a marketplace that links investors looking to increase their cash with businesses in need of funding.

The two main stock exchanges in India are:

The Bombay Stock Exchange, or BSE, is one of the oldest in Asia, having been founded in 1875.

Established in 1992, the National Stock Exchange (NSE) is renowned for its technology-driven activities.

These exchanges serve as regulated centers where trading takes place in accordance with stringent guidelines established by the Securities and Exchange Board of India (SEBI), guaranteeing openness and protecting investors.

The Stock Market: Why Is It Important?

In India’s entire financial ecosystem, the stock market is essential. This is the reason:

Capital for Businesses: To generate money for debt repayment, innovation, or expansion, businesses issue equity shares.

Wealth Creation for Investors: When investors purchase these shares, they do so in anticipation of dividends or capital growth.

Economic Indicator: The nation’s economic health is reflected in the stock market. A rising market frequently indicates economic expansion and investor optimism.

Liquidity: Investors have flexibility in how soon they can acquire or sell their securities.

Equity Shares: What Are They?

Purchasing equity shares of a business entitles you to a portion of its ownership. Although you, as a shareholder, profit from the company’s gains (via dividends or higher stock prices), you also run the risk of losing money if it performs poorly.

For example, the share price of Reliance Industries may increase, giving you gains if you invest in the company’s stock and it reports high earnings. However, a poor financial report can cause the price to decline.

How Does Stock Market Investing Operate?

There are a few fundamental steps involved in stock market investing:

To hold and trade shares, you must first open a trading and demat account. Nowadays, the majority of brokers provide online platforms.

Choose Your Instruments or Stocks: You can invest in huge corporations (large-caps), start-ups (mid-caps), or rapidly expanding startups (small-caps).

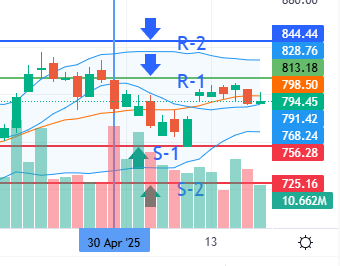

Conduct Research: Prior to making judgments, use techniques such as technical analysis (chart patterns, trends) and fundamental analysis (examining financial reports, earnings).

Place Orders: Purchase or sell in accordance with your research or objectives, such as passive income, short-term gains, or long-term wealth.

Monitor and Modify: Keep tabs on your portfolio and make adjustments as necessary in response to market developments or your own objectives.

Types of Indian Market Investors

A variety of investor categories are present in the Indian stock market, including:

Retail investors are people just like you and me who use brokers or apps to make investments.

Mutual funds, insurance providers, and pension funds are examples of institutional investors.

International investors who bring in money from all around the world are known as foreign institutional investors, or FIIs.

Investors with substantial capital and a greater tolerance for risk are known as high net worth individuals, or HNIs.

Every kind has a distinct impact on the liquidity and behavior of the market.

Typical Investment Choices for the Indian Stock Market

In addition to stock shares, investors can purchase:

Mutual funds are professionally managed pools of investments.

Exchange-traded funds, or ETFs, are assets that trade similarly to shares but represent a basket of equities.

Investing in recently listed businesses is known as an initial public offering, or IPO.

For those wishing to diversify into real estate without actually owning any property, REITs (Real Estate Investment Trusts) are a good option.

Stock Market Investing Risks and Benefits

✅ Benefits

Creating Wealth: In the long run, equities markets have historically performed better than most other asset types.

Dividend Income: Some businesses routinely distribute their profits.

Liquidity: If necessary, you can swiftly sell your shares.

⚠️Hazards:

Market Volatility: Events related to a company, worldwide cues, or economic news can all cause price fluctuations.

Emotional Biases: Greed and fear frequently result in bad choices.

Absence of Research: Ignorant investing can result in losses.

Because of this, it’s critical to match your investing choices to your time horizon, financial objectives, and risk tolerance.

Are You a Good Fit for the Stock Market?

The stock market is worth investigating if you want to increase your wealth, beat inflation, and are prepared to learn the fundamentals of finance. It’s hardly a get-rich-quick plan, though. It requires perseverance, discipline, and lifelong learning.

It’s advisable for novices to begin modestly, learn continuously, and think about diversifying their assets rather than placing all their money on one company.

Concluding remarks

For individuals who are prepared to study and maintain discipline, the Indian stock market presents intriguing chances. Developing your financial literacy is the first stage, whether of your preference for passive income from dividends or long-term riches through equity shares.

Making complicated financial subjects understandable and accessible to regular investors is our mission at NexGen Trade. As we usually suggest, make wise and well-informed investments.

Disclaimer:

This is not the advice on investment; rather, it is meant to be educational and informative only. There are risks associated with stock market investment, therefore before making any decisions, readers should conduct independent research or speak with a licensed financial counselor. The author’s thoughts are their own and may not represent those of this blog or its affiliates.