Learn how to trade the Doji candlestick pattern in the Indian stock market. Understand types, strategies & tips for equity shares and smart investment.

How to Trade Using the Doji Candlestick Pattern in Indian Stock Market

For traders worldwide, candlestick patterns are among the most reliable technical analysis tools. The Doji candlestick stands out among the other patterns due to its capacity to signal market indecision. Knowing how to apply the Doji pattern can significantly impact an Indian trader’s trading approach while dealing in equities shares.

The Doji candlestick pattern, its types, and—above all—how to trade with it in the Indian stock market will all be covered in this blog.

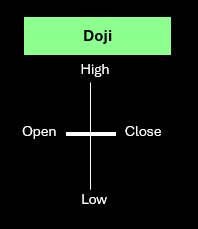

What is a Doji Candlestick Pattern?

When a stock’s opening and closing prices are nearly equal, a Doji candlestick is created, which has a very little or nonexistent body with extended upper and lower shadows. Because neither the buyers (bulls) nor the sellers (bears) are in charge, it represents market indecision.

To put it simply, the Doji indicates that the market is at a turning point, and the course will be decided by the next few candles.

Types of Doji Candlestick Patterns

There are several variations of the Doji candlestick, each with slightly different implications:

1. Standard Doji – Looks like a plus sign (+). It shows pure indecision in the market.

2. Long-Legged Doji – Has long upper and lower shadows, showing high volatility and a tug-of-war between buyers and sellers.

3. Gravestone Doji – Has a long upper shadow and no lower shadow, often seen as a bearish reversal signal at the top of an uptrend.

4. Dragonfly Doji – Has a long lower shadow and no upper shadow, often interpreted as a bullish reversal at the bottom of a downtrend.

Understanding these variations is important because they offer clues about potential price direction.

Why the Doji is Important in the Indian Stock Market

Sharp movements in equity shares are common in the Indian stock market because of its high level of retail participation and rising international institutional investment. Traders can better understand short-term emotion by using candlestick patterns like the Doji.

For example:

Following a robust advance in Nifty 50 equities, the appearance of a Doji may indicate that buyers are waning.

A Doji may suggest that sellers are worn out and that purchasers may come back if it appears after a sharp decline in stocks linked to finance.

Therefore, the Doji is more than just a pattern for Indian traders; it’s a warning to pay close attention to.

How to Trade Using the Doji Candlestick Pattern

Trading with the Doji is not about acting on the pattern alone but combining it with other indicators like volume, support/resistance levels, and moving averages. Here’s how you can approach it:

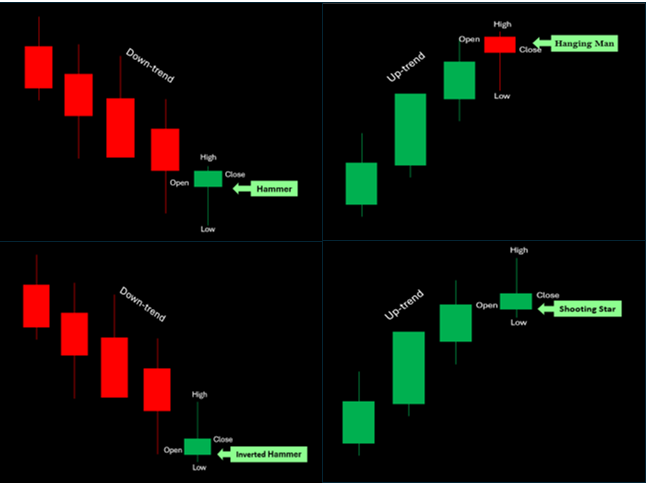

1. Identify the Market Trend

Before reacting to a Doji, analyze the overall trend.

In an uptrend, a Doji might indicate a potential reversal.

In a downtrend, it may signal a pause or reversal.

2. Confirm with the Next Candlestick

Do not trade based on a Doji alone. The next candlestick often provides confirmation.

A bearish candle after a Gravestone Doji strengthens the reversal signal.

A bullish candle after a Dragonfly Doji indicates a potential upward move.

3. Check Support and Resistance Levels

If the Doji forms at a strong support zone, it is more likely to result in a bounce. If it forms near resistance, the chances of reversal are higher.

4. Combine with Volume Analysis

Volume plays a key role in confirming Doji signals. A Doji with high trading volume shows genuine indecision and carries more weight compared to one with low volume.

5. Set Stop-Loss and Targets

Always use stop-loss orders when trading Doji patterns.

For example:

In a bearish setup, the stop-loss can be just above the Doji’s high.

In a bullish setup, the stop-loss can be placed below the Doji’s low.

This ensures you manage risk effectively while trading.

Example: Indian Stocks’ Doji in Action

Assume that the stock of Reliance Industries is rising and trading close to ₹2,500. A Gravestone Doji with heavy volume emerges following several bullish candles. The stock opens lower and closes lower the next day. Traders may be able to book profits or enter a short position with a strict stop-loss if this combination signals a short-term reversal.

In a similar vein, if a Dragonfly Doji appears following a steep decline in a stock in the banking sector, such as HDFC Bank, it may indicate that the downward trend is waning and that a recovery is imminent.

Crucial Advice for Traders

Don’t depend on the Doji candlestick alone. Combine it with additional signs.

Doji patterns on shorter timeframes (5-min or 15-min charts) can be useful in day trading for spotting sudden reversals.

Doji patterns on daily or weekly charts are more dependable for swing traders.

Keep in mind that the Doji is not an indication of reversal but rather of hesitation.

Conclusion:

For traders in the Indian stock market, the Doji candlestick pattern is an effective tool. It represents market hesitancy and frequently portends future equity share reversals. Traders can utilize it to make better investing decisions by combining it with trend analysis, support and resistance, volume, and appropriate risk management.

But keep in mind that no single candlestick pattern ensures success. Practice disciplined trading, continue learning, and incorporate it into a larger plan.

Disclaimer:

This blog is not intended to be financial advice; rather, it is meant to be instructive and informative. There are risks associated with stock market investment, therefore before making any decisions, readers should conduct independent research or speak with a licensed financial counselor. These are the author’s thoughts and may not represent those of NexGen Trade or its affiliates.

drover sointeru

I’m still learning from you, but I’m making my way to the top as well. I definitely liked reading all that is posted on your blog.Keep the stories coming. I loved it!