Dynamic Stock Analysis of Tata Motors 18-09-2025: Is Now the Right Time to Invest for the Long Run?

ChatGPT said:

In this stock analysis, we’ll explore Tata Motors’ recent price performance, key technical indicators, resistance and support levels, and long-term growth outlook to help investors decide whether this is the right time to systematically accumulate its equity shares.

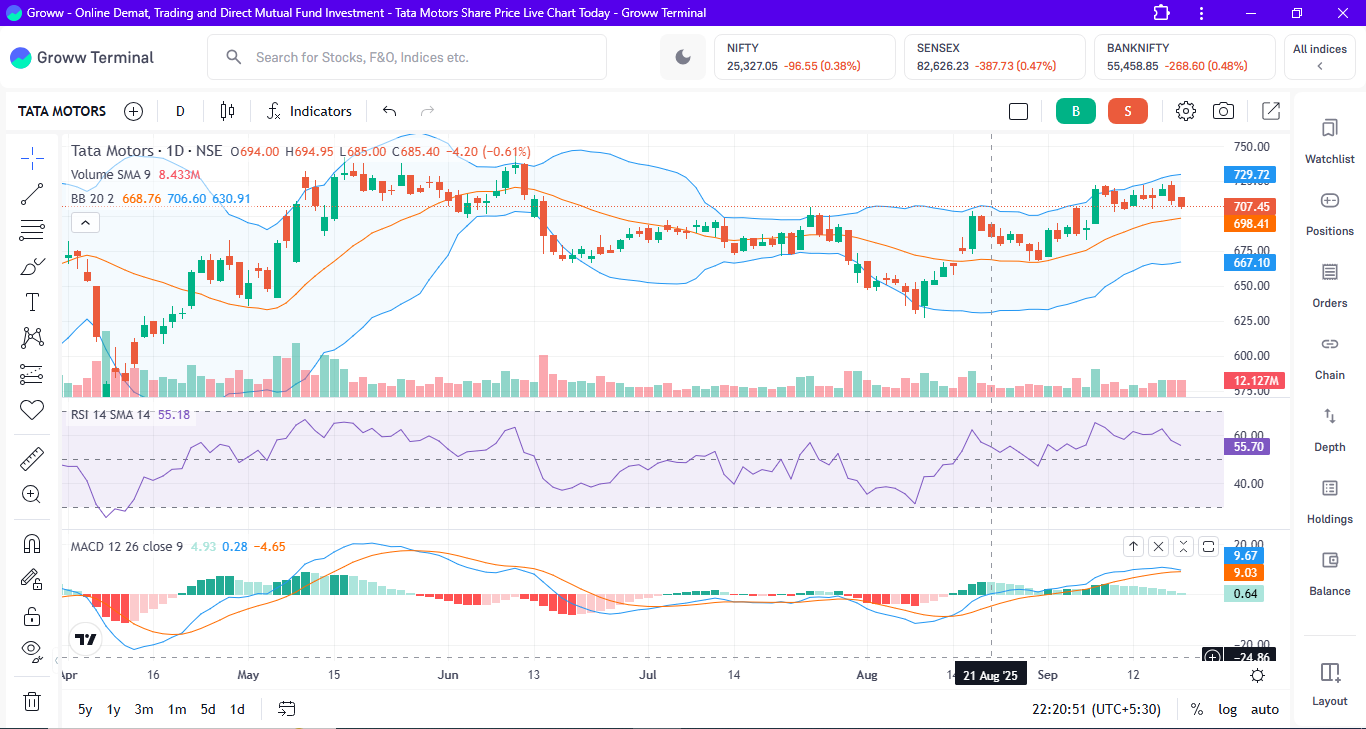

Tata Motors Stock Analysis: Recent Price Action and Market Trend

• 52-week low: ₹535.75

• 52-week high: ₹1000.40

• Recent low: ₹630 (08-08-2025)

• Near-term high: ₹744 (11-06-2025)

• Current (18-09-2025) price action:

o Open: ₹722

o High: ₹725.25

o Low: ₹707.60

o Close: ₹711.20

• Candlestick pattern: Bearish

The stock recently touched levels of ₹744, and it recovered from its prior low of ₹630. But today’s bearish candlestick ending close to ₹711.20 suggests short-term weakness and potential profit booking.

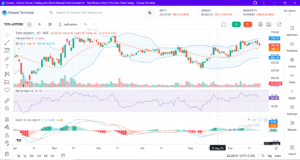

Analysis of Technical Indicators

57.63 is the relative strength index, or RSI.

The stock is neither overbought nor oversold when the RSI is close to 60. This indicates a modest level of strength with room for consolidation.

MACD (Signal line 8.87 against MACD line 10.39)

Although the margin is not very strong, the MACD line is above the signal line, indicating a positive trend.

The Moving Average

Short-term bearishness is indicated by the stock closing below its SMA line.

Bands of Bollinger

Top Band: ₹728.82

Band in the middle: ₹697.31

Lower Band: 665.79

The price of ₹711.20 at the moment is between the middle and upper bands, indicating consolidation with a little possibility of decline.

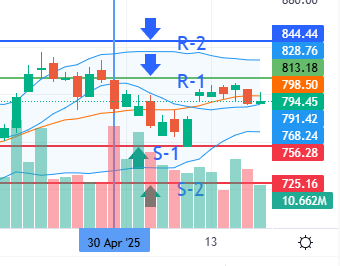

Important Levels of Support and Resistance

Immediate Resistance: ₹728; if the stock is able to break through and hold above this level, ₹750–770 may be the next target.

The middle Bollinger Band at ₹697 and the lower Bollinger Band at ₹665 are the support zones.

Traders’ Stop Loss: ₹690; a break below this mark could allow for more declines.

Is It Better to Wait, Sell, or Buy?

Short-Term View (Trading): Traders could think about waiting instead of opening new positions given the bearish candlestick and price dropping below the SMA.

Long-Term View (Investment): Tata Motors appears appealing for long-term accumulation due to its solid foundation and increasing emphasis on electric vehicles. Instead of making a large investment at the current level, the wisest course of action would be to enter gradually into three sections.

Recommended Long-Term Entry Plan

Initial Entry (Price Range: ₹700–715)

Set aside a third of your investment funds. As the stock is consolidating close to support, this permits exposure.

Second Entry (should the price drop to around ₹665–675)

The lower level of the Bollinger Band offers good support in this area. Here, accumulation guarantees a reduced average cost.

(Breakout over ₹750–770) Third Entry

Bullish continuation would be confirmed if the stock demonstrated strength and maintained above resistance. To take advantage of the long-term gains, invest the remaining money here.

An Overview of Tata Motors Fundamentals

Both domestic and foreign markets are well-served by Tata Motors. Among its primary business verticals are:

Passenger cars: With models like the Nexon, Harrier, and Punch that are well-liked for their price, safety ratings, and design, Tata Motors has made significant headway in the Indian market.

Trucks and buses are among Tata’s leading products in the commercial vehicles market.

Electric vehicles (EVs): With models like the Nexon EV and Tiago EV, Tata Motors leads the Indian EV market. The business has also made large investments in battery technologies and EV infrastructure.

Global Presence: Tata Motors has access to premium markets throughout the world through Jaguar Land Rover (JLR), which allows it to diversify its clientele and geographical reach.

Financial Health: Tata Motors has increased operating profits and drastically decreased debt in recent years. Long-term stability is demonstrated by the strong revenue from both domestic and JLR operations.

Tata Motors is in a strong position to create wealth over the long run because the Indian car industry is expected to grow gradually and EV adoption is accelerating.

Final Outlook

The equity shares of Tata Motors are presently undergoing a consolidation phase from a financial and investment standpoint. The fundamentals are still sound, but technical suggests short-term caution. A three-part entrance strategy lowers market volatility risks and guarantees balanced exposure for long-term investors.

Support Levels: ₹665–697

Resistance Levels: ₹728–770

Stop Loss for Traders: ₹690

Recommendation: Long-term Hold/Accumulate in 3 parts

Tata Motors Price Target Projections

For investors who are prepared to hold for the medium to long term, Tata Motors offers an opportunity when we consider both technical positioning and fundamental growth potential. The estimated price targets are as follows:

Price Target for the First Year (2026): ₹850 to ₹950

supported by consistent growth in the EV market, stable domestic sales, and increased operating margins at JLR.

This is predicated on the stock maintaining its momentum and successfully sustaining above the ₹770 resistance.

Price Target for Three Years (2028): ₹1,200 to ₹1,400

Tata Motors is a potential outperformer because to its strong prospects in India’s EV revolution, worldwide expansion through Jaguar Land Rover, and ongoing debt deleveraging.

The aim also takes into account the Indian equities market’s overall expansion as well as the growing involvement of investors in the EV and car industries.

Disclaimer

This isn’t advice on investments. The content presented here is solely intended for educational purposes. Before making any investing decisions, investors should either speak with a registered financial advisor or do their own research.

Leave a Reply