Tata Steel share breaks past ₹185 with strong momentum! Check trend, RSI, MACD, support, resistance & expert view. Buy, sell, or hold?

NexGen Trade is a fast-growing Indian stock market blog dedicated to helping traders and investors make smarter financial decisions. Our goal is to simplify complex market concepts and provide reliable analysis, actionable insights, and real-time updates on equity shares, trading strategies, and investment trends.

At NexGen Trade, we aim to empower every investor — from beginners to professionals — with the knowledge and confidence to navigate the stock market successfully and build long-term wealth.

Tata Steel Share Price Today – Strong Breakout Above Resistance

The Tata Steel share price continued its bullish rally today, climbing over 2% to reach new highs and breaking past its previous resistance near ₹177.82. The move signals a continuation of the strong uptrend that began after the previous low at ₹153.05.

Today’s Price Data:

- Previous Close: ₹181.81

- Open: ₹183.67

- High: ₹186.90

- Low: ₹182.09

- Current Price: ₹185.83 (+2.15%)

The candle formed today is bullish, supported by increasing volume — indicating strong market participation and momentum.

Technical Analysis of Tata Steel Share

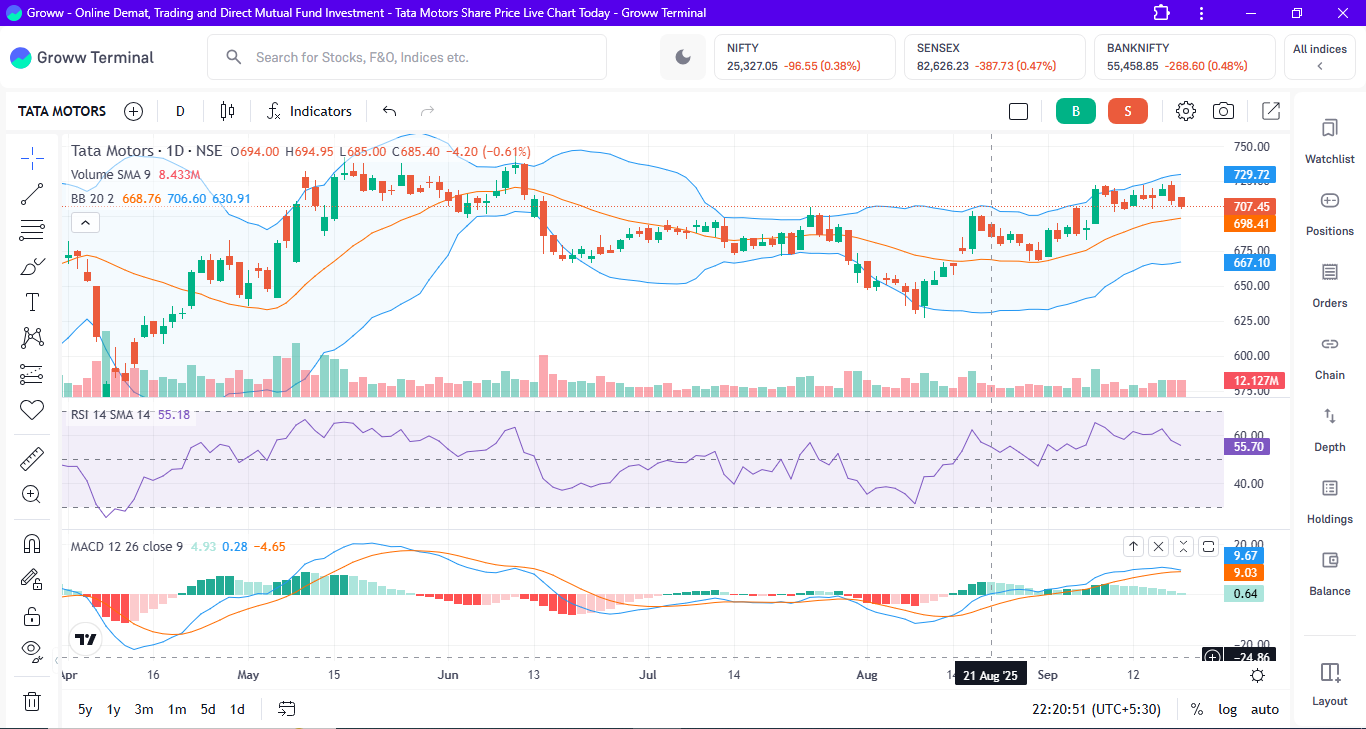

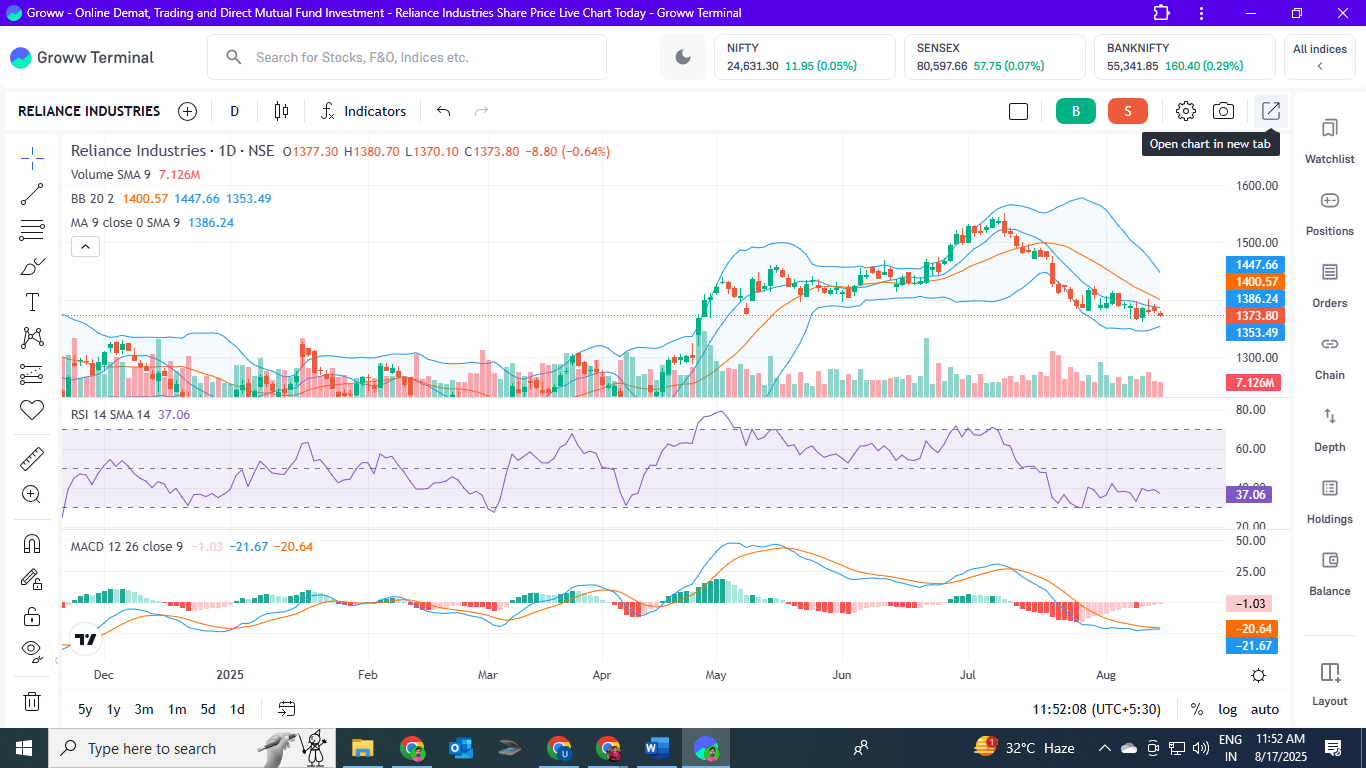

RSI – Momentum Still Strong

- RSI: 73.48

The RSI reading above 70 shows overbought conditions, suggesting the rally is strong but could face near-term profit booking.

MACD – Positive Crossover

- MACD: 2.97

- Signal Line: 2.04

The MACD line has crossed above the signal line, confirming bullish momentum. This crossover supports continuation of the uptrend.

Moving Average & Bollinger Band

- Price above SMA Line → indicates strong upward momentum.

- Bollinger Bands:

- Upper: ₹181.76

- Middle: ₹173.68

- Lower: ₹165.20

The stock is trading above the upper band, showing strong breakout momentum — though short-term consolidation is possible.

Tata Steel Fundamentals at a Glance

Tata Steel Ltd, part of the Tata Group, is one of the world’s largest steel manufacturers with a diverse global presence across Europe, India, and Southeast Asia.

Key Financial & Business Highlights:

- Industry: Metals & Mining

- Market Cap: ~₹2,30,000 crore

- P/E Ratio: ~20x (approx.)

- Dividend Yield: ~2.5%

- Products: Flat & long steel, automotive steel, engineering products, and construction-grade steel.

- Growth Drivers: India’s infrastructure expansion, global demand recovery, and margin improvement in the domestic segment.

Tata Steel’s strong balance sheet, deleveraging focus, and global operations make it a long-term favorite among investors.

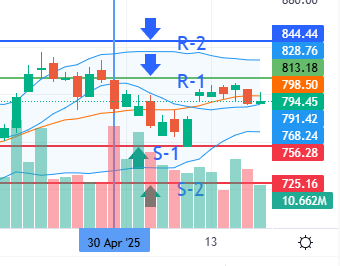

Support, Resistance & Stop-Loss Levels

| Level Type | Price (₹) |

|---|---|

| Immediate Support | 182.00 |

| Strong Support | 177.80 |

| Immediate Resistance | 188.00 |

| Next Resistance | 192.50 |

| Stop-Loss (for traders) | 181.50 |

If the price sustains above ₹188, Tata Steel could move toward ₹192–₹195. However, if it falls below ₹182, a short-term pullback may occur.

Buy, Sell or Hold – Expert View on Tata Steel

Short-Term View

With RSI in the overbought zone and MACD showing strength, traders may see a short-term upside.

👉 Recommendation: Buy on dips near ₹182–₹184

👉 Target: ₹192–₹195

👉 Stop-Loss: ₹181.50

Long-Term View

Tata Steel remains fundamentally strong with steady earnings and expansion projects. Long-term investors can accumulate on dips, considering the company’s consistent profitability and global scale.

Key Takeaways

- Tata Steel share price shows strong momentum above resistance.

- RSI and MACD confirm continued bullish strength.

- Traders can buy on dips with tight stop-loss management.

- Investors can hold or accumulate for long-term growth potential.

- Overbought levels suggest possible short-term consolidation.

Frequently Asked Questions (FAQ)

Q1. Is Tata Steel a good stock to buy now?

Yes, Tata Steel shows strong bullish momentum with a breakout above ₹185. It’s suitable for buy-on-dip strategies, with a stop-loss at ₹181.50.

Q2. What is the target price for Tata Steel share?

Short-term target stands between ₹192–₹195, depending on market sentiment and strength above ₹188 resistance.

Q3. Is Tata Steel overbought right now?

The RSI of 73.48 indicates short-term overbought conditions. Some consolidation may happen before the next leg of rally.

Q4. How does Tata Steel compare with SAIL and JSW Steel?

All three are major steel players. Tata Steel has better global diversification, while SAIL and JSW Steel are more domestic-focused.

Q5. Should I hold Tata Steel for the long term?

Yes. Strong fundamentals, robust earnings, and global growth opportunities make Tata Steel a good long-term investment.

Final Verdict – Buy, Sell, or Wait?

Considering the price action and indicators:

✅ Short-Term Traders: Buy on dips near ₹182–₹184 with a target of ₹192–₹195.

⚠️ Stop-Loss: ₹181.50

✅ Long-Term Investors: Hold and accumulate gradually for long-term growth.

The stock’s strength, coupled with positive fundamentals, makes Tata Steel one of the best stocks to buy today.

Disclaimer

This article is for educational purposes only and not investment advice. Stock market investments are subject to risks. Please consult a financial advisor before investing.

Leave a Reply