How to Control Emotions in Trading to Avoid Losses

1. Why Emotions Matter in Trading & Investing

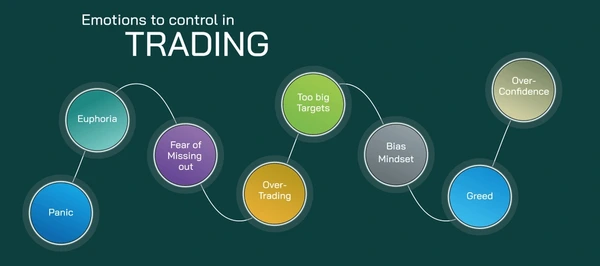

Understanding how to control emotions in trading is one of the most important skills every trader and investor must learn. In the share market today, prices move rapidly due to news, global cues, and market sentiment. Fear, greed, hope, and panic often influence decisions more than logic. Emotional trading leads to impulsive buying at highs and panic selling at lows. Successful investors focus on discipline, patience, and strategy rather than reacting emotionally to short-term market movements.

Most beginners in the stock market struggle with emotional traps like fear of loss, greed for quick profits, and overconfidence after a winning trade. Fear can stop you from entering good opportunities, while greed can make you hold losing positions longer than necessary. Many people searching for the best stocks to buy today end up chasing momentum without proper analysis. Recognizing these emotional patterns is the first step toward mastering emotional control.

3. Importance of a Trading Plan and Strategy

A well-defined trading or investment plan plays a crucial role in learning how to control emotions in trading. Your plan should include entry price, exit target, stop-loss level, and position size. When you follow a structured plan, decisions are based on logic rather than emotions. Whether you are trading intraday or investing for the long term, a plan removes uncertainty and builds confidence, especially in volatile market conditions.

4. Risk Handling: The Key to Emotional Stability

Proper risk management reduces stress and emotional pressure. Never risk more than a small percentage of your capital on a single trade. Using stop-loss orders protects you from large losses and helps maintain mental peace. Many traders fail not because of poor stock selection, but due to poor risk management. Learning stock market basics like capital allocation and risk-reward ratio can significantly improve emotional discipline.

5. Develop the Right Mindset for Long-Term Success

Successful traders treat trading as a business, not gambling. Losses are part of the process and should be accepted calmly. Instead of focusing only on profits, focus on following your system consistently. If you want to learn stock market trading seriously, you must develop patience and emotional resilience. Avoid constantly checking prices and reacting to every market move, especially when the share market today is highly volatile.

6. Continuous Learning and Self-Reflection

One of the best ways to control emotions is continuous learning and self-analysis. Maintain a trading journal to record your trades, emotions, and mistakes. Reviewing past trades helps you identify emotional patterns and improve decision-making. Strengthening your knowledge of stock market basics, technical analysis, and fundamentals builds confidence and reduces emotional dependency on tips or market noise.

7. Avoid Overtrading and Market Noise

Overtrading is often driven by emotions like boredom, excitement, or revenge trading after a loss. Not every day offers the best trading opportunity. Learning when not to trade is equally important. Ignore social media hype and rumors about the best stocks to buy today unless backed by proper analysis. Staying selective and disciplined helps you remain emotionally balanced and focused on long-term goals.

Conclusion

Learning how to control emotions in trading is a continuous journey that separates successful traders from unsuccessful ones. Emotional discipline, a solid trading plan, risk management, and continuous learning are the foundation of consistent profits. In the ever-changing share market today, staying calm and rational gives you a strong edge. If you truly want to learn stock market trading and investing, start by mastering your emotions—because the biggest battle in trading is not with the market, but with yourself.

Disclaimer

This blog is for educational and informational purposes only and should not be considered financial, investment, or trading advice. Stock markets are subject to risks, and past performance does not guarantee future results. Always consult a SEBI-registered financial advisor before making any investment decisions. The companies or stocks mentioned here are included solely for learning and research purposes—not as recommendations. NexGen Trade encourages readers to perform their own analysis and invest responsibly.

Frequently Asked Questions

Why is emotional control important in trading?

Emotional control helps traders make logical decisions instead of reacting to fear or greed. It reduces impulsive trades and improves consistency in long-term trading and investing.

What emotions affect traders the most?

The most common emotions are fear, greed, overconfidence, panic, and hope. These emotions often lead to poor entry and exit decisions in the share market today.

How can beginners control emotions in trading?

Beginners should start with stock market basics, use a simple trading plan, apply strict stop-loss rules, and avoid risking too much capital on a single trade.

Does using a stop-loss help control emotions?

Yes, stop-loss orders limit losses automatically, reduce stress, and prevent emotional decisions during sudden market volatility.

Can long-term investing reduce emotional stress?

Long-term investing generally involves less emotional pressure compared to short-term trading, as it focuses on fundamentals rather than daily price fluctuations.

How long does it take to master emotional control in trading?

Emotional control develops with experience, discipline, and continuous learning. Most traders improve over time by analyzing mistakes and following a consistent strategy.