1. What Is Swing Trading and Why It Matters Today

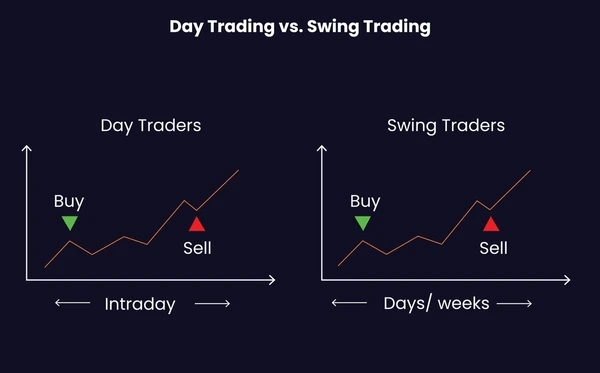

Swing Trading is a popular short-term trading style where traders aim to capture price movements over a few days to weeks. In today’s fast-moving Indian share market, swing trading has become especially attractive due to rising volatility, frequent sector rotation, and active participation from retail investors. Unlike long-term investing, swing trading focuses on timing the market using technical analysis rather than fundamentals alone. For beginners learning the stock market, swing trading offers a balanced approach—less stressful than intraday trading and faster than long-term investing. With the share market today offering multiple opportunities across sectors, swing trading helps traders benefit from short-term trends while managing risk effectively.

2. Core Principles of Successful Swing Trading

The foundation of successful swing trading lies in trend identification and disciplined execution. Traders typically look for stocks that are trending upward or downward with strong momentum. Understanding stock market basics such as support, resistance, volume, and trendlines is essential. Risk management plays a crucial role—using stop-loss orders ensures that losses remain limited if the trade goes wrong. Position sizing is another important principle, helping traders avoid overexposure. Swing traders also focus on patience, waiting for the right setup instead of chasing prices. For anyone looking to learn stock market trading, mastering these principles is more important than finding quick profits.

3. Best Swing Trading Strategies in India

Several proven strategies work well for swing trading in Indian markets. One popular approach is breakout trading, where traders enter a stock once it breaks above a strong resistance level with high volume. Another effective method is pullback trading, where traders buy stocks in an uptrend during temporary price corrections. Moving average crossover strategies, such as using the 20-day and 50-day moving averages, help identify trend reversals early. RSI and MACD indicators are also widely used to spot momentum shifts. These strategies are commonly applied to identify the best stocks to buy today based on price action and technical strength.

4. Essential Tools for Swing Traders

Using the right tools can significantly improve swing trading performance. Charting platforms like TradingView, Zerodha Kite, and Upstox provide advanced technical indicators and real-time data. Stock screeners help traders filter stocks based on volume, price range, and trend strength—saving time and improving accuracy. Keeping track of share market today news, corporate announcements, and sector trends is equally important, as sudden events can impact stock prices. A well-maintained trading journal is another powerful tool, allowing traders to review past trades, analyze mistakes, and refine strategies over time.

While swing trading offers attractive profit potential, it also involves risks if not managed properly. Traders should never risk more than a small percentage of their capital on a single trade and must always follow stop-loss rules. Emotional control is key—fear and greed often lead to poor decisions. Beginners should start with small capital, focus on learning stock market basics, and gradually scale up as confidence grows. In conclusion, swing trading in India can be a powerful way to generate consistent returns when backed by sound strategies, reliable tools, and disciplined risk management. With practice and patience, swing trading can become a valuable skill in your overall trading journey.

Disclaimer

This Article is for educational and informational purposes only and should not be considered financial, investment, or trading advice. Stock markets are subject to risks, and past performance does not guarantee future results. Always consult a SEBI-registered financial advisor before making any investment decisions. The companies or stocks mentioned here are included solely for learning and research purposes—not as recommendations. NexGen Trade encourages readers to perform their own analysis and invest responsibly.

Frequently Asked Questions

What is swing trading in the Indian stock market?

Swing trading is a short-term trading strategy where traders hold stocks for a few days to weeks to capture price movements using technical analysis.

Is swing trading suitable for beginners in India?

Yes, swing trading is suitable for beginners as it requires less screen time than intraday trading and helps in learning stock market basics gradually.

How much capital is required for swing trading?

There is no fixed amount, but beginners can start swing trading with ₹10,000–₹25,000 while following proper risk management rules.

Which indicators are best for swing trading?

Popular indicators for swing trading include Moving Averages, RSI, MACD, Bollinger Bands, and volume analysis.

How to find the best stocks to buy today for swing trading?

Traders can use stock screeners, breakout patterns, volume spikes, and trend analysis to identify the best stocks to buy today.

Is swing trading profitable in the long run?

Swing trading can be profitable if traders follow disciplined strategies, control emotions, and consistently manage risk.